Improving comprehension of retirement planning options at Morningstar

Problem:

Plan participants with access to Retirement Manager frequently called into their providers for support on how to make the right decisions for their retirement within the platform. These users expressed confusion around what would happen after they finished a Retirement Manager session, regardless of which service level they chose—would anything happen to their account today? What exactly does it mean to manage their own plans? And why should they enroll in Managed Accounts, Morningstar’s investment management algorithm?

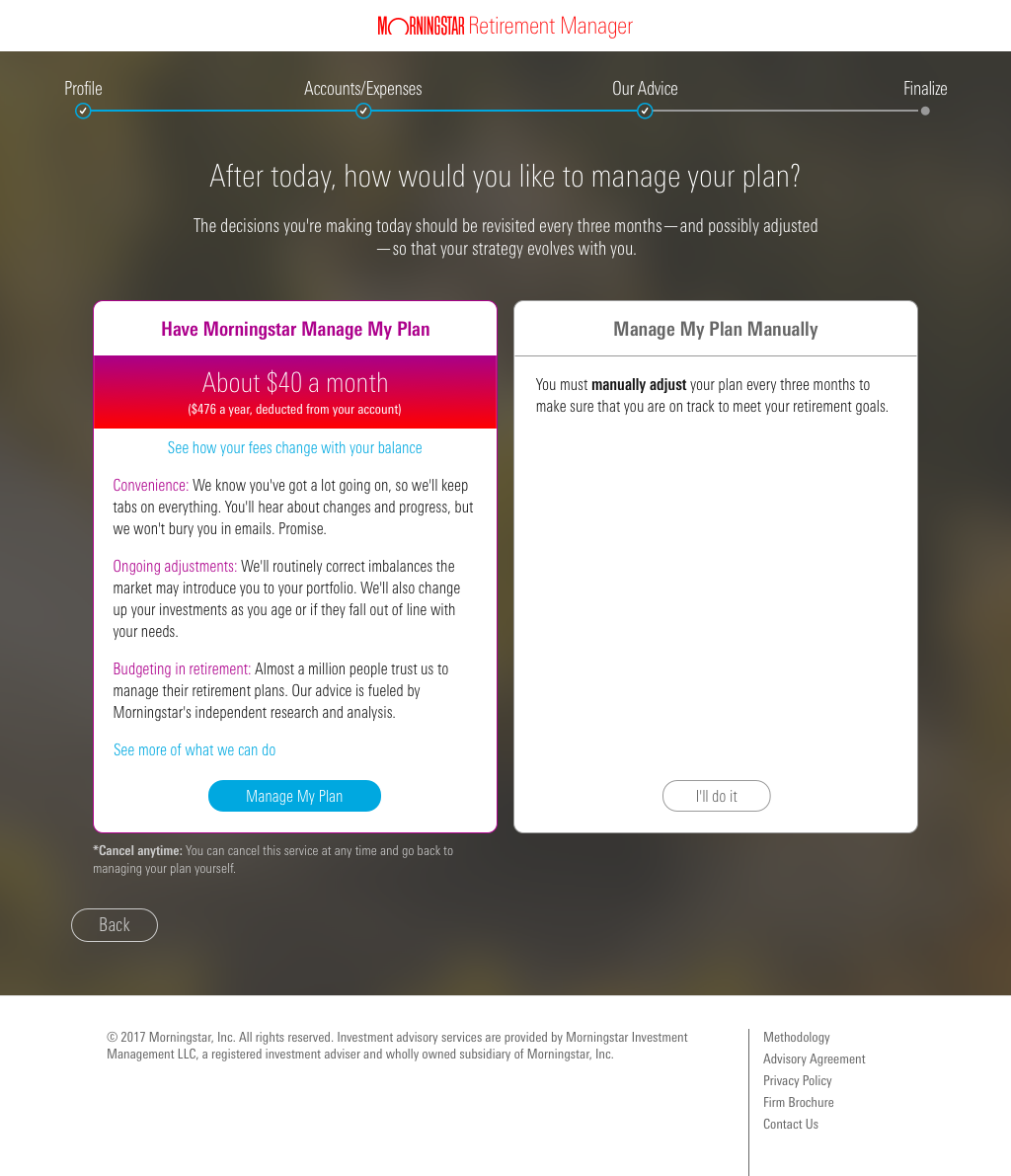

The existing version of the “Buy Decision” flow sacrificed nuance about the service options, and led to confusion about what today’s session accomplished.

This problem was two-fold: users misunderstood both the service levels available, as well as what would happen after they made a decision.

Task:

We needed to help users improve comprehension of both service options, including the benefits and differentiators of Managed Accounts, as well as ensure they left the flow understanding the outputs of the day’s RM session. We also needed to ladder our work up to 2021 OKRs, which included an org-wide drive to increase MA enrollment by a given percent.

My role:

As the team’s only UX writer, I partnered with one of our designers to develop and test new language and structure for the flow that helped users understand their options and make the best decision for their goals.

What I did:

I started with content discovery, including Morningstar investment and product stakeholders, as well as the plan provider client.

In 2019, Morningstar’s Workplace Solutions group conducted user research identifying overlapping groups of “investor maturity,” from beginner/casual investors who want everything on autopilot, to highly advanced investors who were more likely to pick their own funds than use a tool like Retirement Manager.

With these stakeholders (and our investor maturity model in mind), I conducted talk bubble exercises with the intent that empathy with the individual investor was critical to building a better mental model of our client’s range of plan participants. We needed to do this with a range of stakeholders, since we would not be allowed direct contact with actual participants to conduct interviews.

In these discovery sessions with the team, we realized that the language we used forced participants to consider what they wanted Morningstar to do, rather than what they themselves wanted to do around managing their retirement plans.

After these sessions, I spent one sprints pair writing with my designer as well as individual stakeholders to generate testable content and break out the “next steps” for the participant more clearly.

We then did an unmoderated usability test using our new language on usertesting.com:

Learnings:

Headlines focused on participants’ investing style helped them connect their choice of service option to their own investing preferences, particularly Managed Accounts.

Although participants generally understood the Advice-only option, most did not recognize that this option would result in changes to their 401k.

We took these results and focused on outlining today’s steps, followed by allowing participants to self-identify with how they’d manage their retirement accounts moving forward—with Morningstar implementing a service level accordingly.

Outcome:

Metrics TBD Q3 2021